Multiple Choice

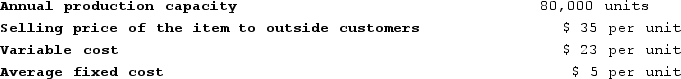

Division P of the Nyers Company makes a part that can either be sold to outside customers or transferred internally to Division Q for further processing. Annual data relating to this part are as follows:  Division Q of the Nyers Company requires 15,000 units per year and is currently paying an outside supplier $33 per unit. Consider each part below independently.If outside customers demand 80,000 units and if, by selling to Division Q, Division P could avoid $4 per unit in variable selling expense, then according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

Division Q of the Nyers Company requires 15,000 units per year and is currently paying an outside supplier $33 per unit. Consider each part below independently.If outside customers demand 80,000 units and if, by selling to Division Q, Division P could avoid $4 per unit in variable selling expense, then according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

A) $35 per unit

B) $21 per unit

C) $31 per unit

D) $33 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q259: Shrewsbury Incorporated reported the following results from

Q260: Sauseda Corporation has two operating divisions-an Inland

Q261: Fingado Products, Incorporated, has a Detector Division

Q262: The Casket Division of Saal Corporation had

Q263: If net operating income is $39,000, average

Q265: The following information relates to last year's

Q266: Royal Products, Incorporated, has a Connector Division

Q267: Parsa Incorporated reported the following results from

Q268: Fabbri Wares is a division of a

Q269: The Downstate Block Company has a trucking