Multiple Choice

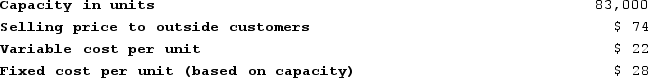

Tommasino Products, Incorporated, has a Motor Division that manufactures and sells a number of products, including a standard motor that could be used by another division in the company, the Automotive Division, in one of its products. Data concerning that motor appear below:  The Automotive Division is currently purchasing 9,000 of these motors per year from an overseas supplier at a cost of $72 per motor.Assume that the Motor Division has enough idle capacity to handle all of the Automotive Division's needs. Does there exist a transfer price that would make both the Motor and Automotive Division financially better off than if the Automotive Division were to continue buying its motors from the outside supplier?

The Automotive Division is currently purchasing 9,000 of these motors per year from an overseas supplier at a cost of $72 per motor.Assume that the Motor Division has enough idle capacity to handle all of the Automotive Division's needs. Does there exist a transfer price that would make both the Motor and Automotive Division financially better off than if the Automotive Division were to continue buying its motors from the outside supplier?

A) Yes, both divisions are always better off regardless of whether the selling division has enough idle capacity to handle all of the buying division's needs.

B) No, the selling division's price to outside customers is higher than the price that the buying division has to pay its outside supplier.

C) Yes, the minimum transfer price that the selling division should be willing to accept is less than the maximum transfer price that the buying division would accept.

D) The answer cannot be determined from the information that has been provided.

Correct Answer:

Verified

Correct Answer:

Verified

Q295: The Millard Division's operating data for the

Q296: The Southern Division of Barstol Company makes

Q297: Bacot Products, Incorporated, has a Valve Division

Q298: Smurnov Company has a purchasing department that

Q299: The following data has been provided for

Q301: Criner Incorporated reported the following results from

Q302: The selling division in a transfer pricing

Q303: Starcic Products, Incorporated, has a Connector Division

Q304: An advantage of using return on investment

Q305: Selma Incorporated reported the following results from