Multiple Choice

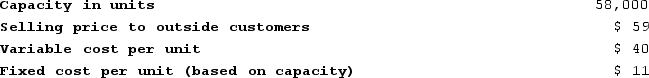

Yearout Products, Incorporated, has a Valve Division that manufactures and sells a number of products, including a standard valve that could be used by another division in the company, the Pump Division, in one of its products. Data concerning that valve appear below:  The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $53 per valve.Assume that the Valve Division is selling all of the valves it can produce to outside customers. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $53 per valve.Assume that the Valve Division is selling all of the valves it can produce to outside customers. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

A) Yes, the minimum transfer price that the selling division should be willing to accept is less than the maximum transfer price that the buying division should be willing to accept.

B) No, the minimum transfer price that the selling division should be willing to accept exceeds the maximum transfer price that the buying division should be willing to accept.

C) The answer cannot be determined from the information that has been provided.

D) Yes, both divisions are always better off regardless of whether the selling division has enough idle capacity to handle all of the buying division's needs.

Correct Answer:

Verified

Correct Answer:

Verified

Q314: Financial data for Beaker Company for last

Q315: When a dispute arises over a transfer

Q316: Cichy Products, Incorporated, has a Valve Division

Q317: Bonilla Incorporated has a $700,000 investment opportunity

Q318: Cabell Products is a division of a

Q320: Parsa Incorporated reported the following results from

Q321: The following data are for the Akron

Q322: The West Division of Cecchetti Corporation had

Q323: Dacker Products is a division of a

Q324: Leete Incorporated reported the following results from