Multiple Choice

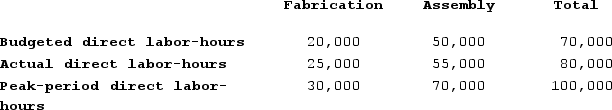

Nafth Company has an Equipment Services Department that performs all needed maintenance work on the equipment in the company's Fabrication and Assembly Departments. Costs of the equipment Services Department are charged to the Fabrication and Assembly Departments on the basis of direct labor-hours. Data on direct labor-hours for last year follow:  For the year just ended, the company budgeted its variable maintenance costs at $210,000 for the year. Actual variable maintenance costs for the year totaled $255,000.For performance evaluation purposes, how much of the $255,000 of actual variable maintenance cost should be charged to the Assembly Department at the end of the year just ended?

For the year just ended, the company budgeted its variable maintenance costs at $210,000 for the year. Actual variable maintenance costs for the year totaled $255,000.For performance evaluation purposes, how much of the $255,000 of actual variable maintenance cost should be charged to the Assembly Department at the end of the year just ended?

A) $182,143

B) $175,312

C) $165,000

D) $178,500

Correct Answer:

Verified

Correct Answer:

Verified

Q131: For performance evaluation purposes, the actual fixed

Q132: Sauseda Corporation has two operating divisions--an Inland

Q133: The Downstate Block Company has a trucking

Q134: Gauntlett Incorporated reported the following results from

Q135: Trendell Products, Incorporated, has a Motor Division

Q137: The Millard Division's operating data for the

Q138: Fingado Products, Incorporated, has a Detector Division

Q139: Division P of the Nyers Company makes

Q140: Division Y has asked Division X of

Q141: Stokan Products, Incorporated, has a Antennae Division