Essay

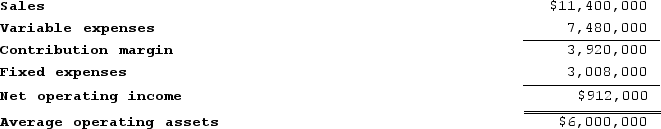

Ranallo Incorporated reported the following results from last year's operations:

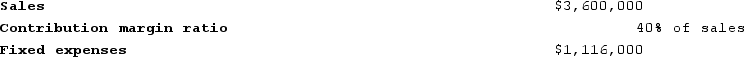

At the beginning of this year, the company has a $1,800,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,800,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1. What was last year's margin? (Round to the nearest 0.1%.)

2. What was last year's turnover? (Round to the nearest 0.01.)

3. What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4. What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5. What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6. What is the return on investment related to this year's investment opportunity? (Round to the nearest 0.1%.)

7. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

8. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

9. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall return on investment will this year? (Round to the nearest 0.1%.)

10. If Westerville's chief executive officer earns a bonus only if the return on investment for this year exceeds the return on investment for last year, would the chief executive officer pursue the investment opportunity? Would the owners of the company want the chief executive officer to pursue the investment opportunity?

11. What was last year's residual income?

12. What is the residual income of this year's investment opportunity?

13. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall residual income this year?

14. If Westerville's chief executive officer earns a bonus only if residual income for this year exceeds residual income for last year, would the chief executive officer pursue the investment opportunity?

Correct Answer:

Verified

1. Last year's Margin = Net operating in...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q210: Zumsteg Products, Incorporated, has a Pump Division

Q211: Setting transfer prices at full cost can

Q212: Two of the decentralized divisions of Gamberi

Q213: Minar Incorporated reported the following results from

Q214: The transfer price used for internal transfers

Q216: Ganus Products, Incorporated, has a Relay Division

Q217: A segment of a business responsible for

Q218: Toldness Products, Incorporated, has a Connector Division

Q219: Eady Wares is a division of a

Q220: Nanke Products, Incorporated, has a Sensor Division