Essay

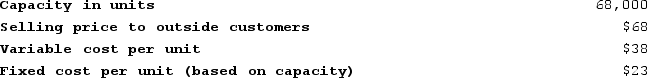

Manni Products, Incorporated, has a Pump Division that manufactures and sells a number of products, including a standard pump. Data concerning that pump appear below:

The company has a Pool Products Division that needs 7,000 special heavy-duty pumps per year. The Pump Division's variable cost to manufacture and ship this special pump would be $43 per unit. Making these special pumps would require more manufacturing resources. Therefore, the Pump Division would have to reduce its production and sales of regular pumps to outside customers from 68,000 units per year to 56,100 units per year.

The company has a Pool Products Division that needs 7,000 special heavy-duty pumps per year. The Pump Division's variable cost to manufacture and ship this special pump would be $43 per unit. Making these special pumps would require more manufacturing resources. Therefore, the Pump Division would have to reduce its production and sales of regular pumps to outside customers from 68,000 units per year to 56,100 units per year.

Required:

As far as the Pump Division is concerned, what is the lowest acceptable transfer price for the special pumps?

Correct Answer:

Verified

To produce the 7,000 special pumps, the ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q249: Agustin Industries is a division of a

Q250: Blitch Products, Incorporated, has a Screen Division

Q251: Division A makes a part with the

Q252: Ebbs Products, Incorporated, has a Motor Division

Q253: Some investment opportunities that should be accepted

Q255: Prejean Products, Incorporated, has a Relay Division

Q256: Boespflug Incorporated has a $1,000,000 investment opportunity

Q257: Wetherald Products, Incorporated, has a Pump Division

Q258: Parsa Incorporated reported the following results from

Q259: Shrewsbury Incorporated reported the following results from