Lincoln, Incorporated, Washington, Incorporated, and Adams, Incorporated, Form Presidential Suites

Essay

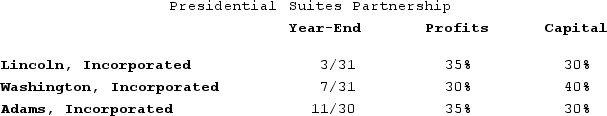

Lincoln, Incorporated, Washington, Incorporated, and Adams, Incorporated, form Presidential Suites Partnership on February 15, 20X9. Now, Presidential Suites must adopt its required tax year-end. The partners' year-ends, profits interests, and capital interests are reflected in the table below. Given this information, what tax year-end must Presidential Suites use, and what rule requires this year-end?

Correct Answer:

Verified

Because the partners all have different ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Adjustments to a partner's outside basis are

Q17: Ruby's tax basis in her partnership interest

Q21: Clint noticed that the Schedule K-1 he

Q24: Jay has a tax basis of $20,000

Q25: Sue and Andrew form SA general partnership.

Q37: Partnerships can request up to a six-month

Q38: Sarah, Sue, and AS Incorporated formed a

Q61: XYZ, LLC, has several individual and corporate

Q73: Which of the following statements regarding the

Q96: What is the difference between a partner's