Essay

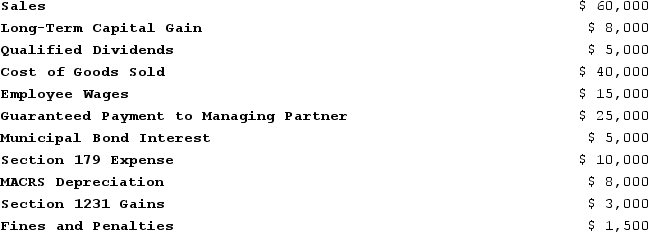

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Correct Answer:

Verified

($28,000),...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Bob is a general partner in Fresh

Q23: The main difference between a partner's tax

Q25: Which of the following does not represent

Q43: Which of the following items is subject

Q44: This year, Reggie's distributive share from Almonte

Q73: Lloyd and Harry, equal partners, form the

Q76: Jerry, a partner with 30 percent capital

Q104: Fred has a 45percent profits interest and

Q113: Any losses that exceed the tax basis

Q114: Partners must generally treat the value of