Essay

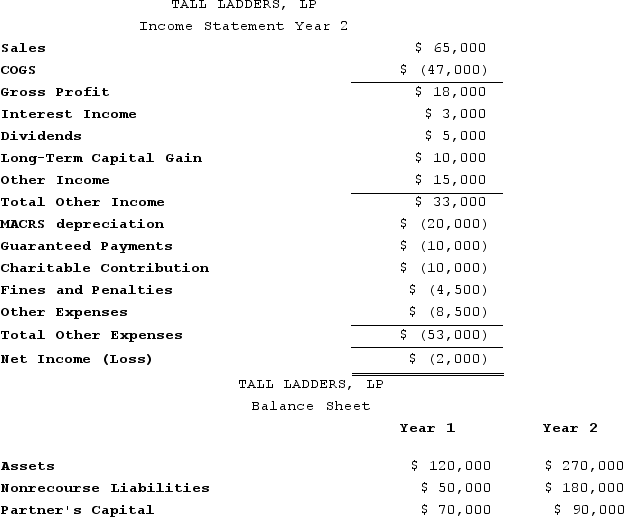

At the end of Year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For Year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following income statement and balance sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of Year 2?

Correct Answer:

Verified

Tony's adjusted basis at the end of Year...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: When must a partnership file its return?<br>A)By

Q36: Under proposed regulations issued by the Treasury

Q64: Zinc, LP was formed on August 1,

Q76: Jerry, a partner with 30 percent capital

Q79: Illuminating Light Partnership had the following revenues,

Q83: Jerry, a partner with 30percent capital and

Q88: Partnerships can use special allocations to shift

Q93: Which of the following would not be

Q107: Gerald received a one-third capital and profit

Q122: On March 15, 20X9, Troy, Peter, and