Essay

Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

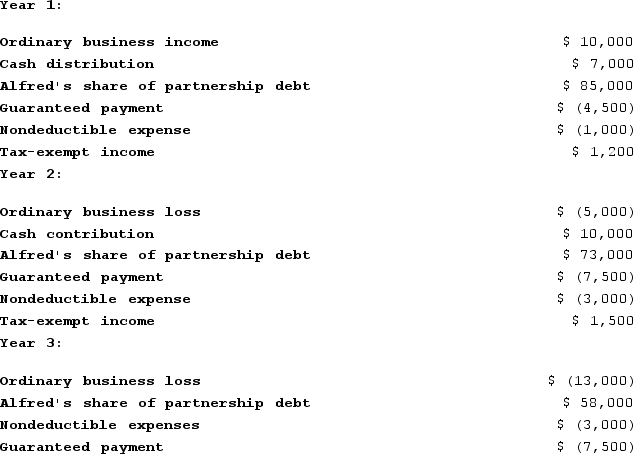

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Correct Answer:

Verified

At the end of Year 2, Alfred's basis is ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Which of the following statements exemplifies the

Q32: KBL, Incorporated, AGW, Incorporated, Blaster, Incorporated, Shiny

Q33: Jordan, Incorporated, Bird, Incorporated, Ewing, Incorporated, and

Q35: Erica and Brett decide to form their

Q38: Sarah, Sue, and AS Incorporated formed a

Q50: Hilary had an outside basis in LTL

Q61: XYZ, LLC, has several individual and corporate

Q72: Which of the following rationales for adjusting

Q97: The character of each separately stated item

Q102: Kim received a one-third profits and capital