Essay

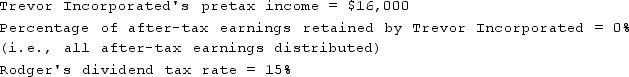

Rodger owns 100 percent of the shares in Trevor Incorporated a C corporation. Assume the following for the current year:

Given these assumptions, how much cash does Rodger have from the dividend after paying taxes on the distribution?

Given these assumptions, how much cash does Rodger have from the dividend after paying taxes on the distribution?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: Which legal entity provides the least flexible

Q16: S corporation shareholders who work for the

Q28: LLC <!--Markup Copied from Habitat--> members have

Q42: Owners who work for entities taxed as

Q47: Roberto and Reagan are both 25-percent owner/managers

Q56: In 2020, Aspen Corporation reported $120,000 of

Q62: Both tax and nontax objectives should be

Q72: If a C corporation incurred a net

Q75: Sole proprietorships that are not organized as

Q77: Which of the following statements is false