Essay

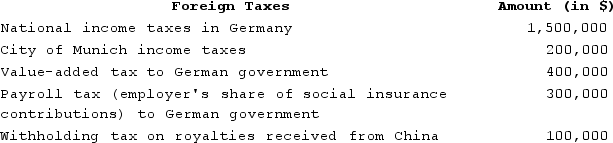

Rainier Corporation, a U.S. corporation, manufactures and sells quidgets in the United States and Europe. Rainier conducts its operations in Europe through a German GmbH, which the company elects to treat as a branch for U.S. tax purposes. Rainier also licenses the rights to manufacture quidgets to an unrelated company in China. During the current year, Rainier paid the following foreign taxes, translated into U.S. dollars at the appropriate exchange rate:

What amount of creditable foreign taxes does Rainier incur?

What amount of creditable foreign taxes does Rainier incur?

Correct Answer:

Verified

$1,800,000.The creditable inco...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Horton Corporation is a 100 percent owned

Q21: Gwendolyn was physically present in the United

Q25: Which of the following transactions engaged in

Q29: Cecilia, a Brazilian citizen and resident, spent

Q41: Portsmouth Corporation, a British corporation, is a

Q57: A hybrid entity established in Ireland is

Q84: Austin Corporation, a U.S. corporation, received the

Q86: Pierre Corporation has a precredit U.S. tax

Q102: Subpart F income earned by a CFC

Q104: Boca Corporation, a U.S. corporation, reported U.S.