Multiple Choice

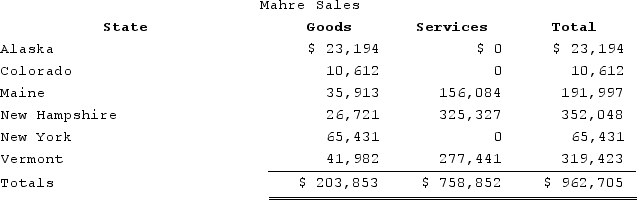

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store, which ships to out-of-state customers. Assume sales transactions in all states, except New York, are under 200 and that all states have adopted Wayfair legislation. The ski tours operate in Maine, New Hampshire, and Vermont, where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (0 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (0 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit?

A) $10,386

B) $14,543

C) $26,733

D) $61,289

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The state tax base is computed by

Q6: Business income is allocated to the state

Q10: Which of the following is not a

Q34: List the steps necessary to determine an

Q57: Gordon operates the Tennis Pro Shop in

Q67: Public Law 86-272 protects only companies selling

Q100: All 50 states impose a sales and

Q105: In recent years, states are weighting the

Q126: Lefty provides demolition services in several southern

Q135: Gordon operates the Tennis Pro Shop in