Multiple Choice

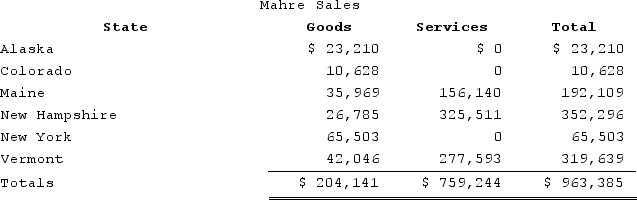

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store, which ships to out-of-state customers. Assume sales transactions in all states, except New York, are under 200 and that all states have adopted Wayfair legislation. The ski tours operate in Maine, New Hampshire, and Vermont, where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (0 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (0 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit?

A) $10,400

B) $14,470

C) $26,749

D) $61,305

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Federal/state adjustments correct for differences between two

Q22: The Mobil decision identified three factors to

Q52: Immaterial violations of the solicitation rules automatically

Q58: The payroll factor includes payments to independent

Q71: Lefty provides demolition services in several southern

Q79: Tennis Pro has the following sales, payroll,

Q87: Which of the items is correct regarding

Q98: What was the Supreme Court's holding in

Q134: All states employ some combination of sales

Q135: Economic presence always creates sales tax nexus.