Multiple Choice

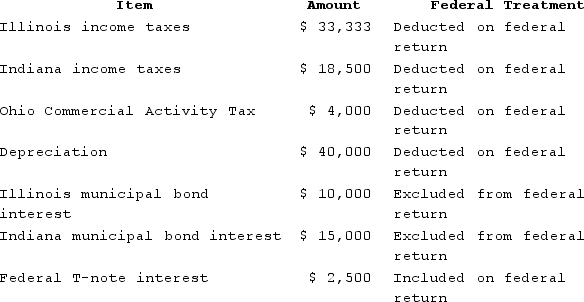

Hoosier Incorporated is an Indiana corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  State depreciation expense was $50,000. Hoosier's federal taxable income was $150,300. Calculate Hoosier's Indiana state tax base.

State depreciation expense was $50,000. Hoosier's federal taxable income was $150,300. Calculate Hoosier's Indiana state tax base.

A) $171,300

B) $173,800

C) $199,633

D) $207,133

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The state tax base is computed by

Q23: Tennis Pro is headquartered in Virginia. Assume

Q33: Assume Tennis Pro discovered that one salesperson

Q45: Gordon operates the Tennis Pro Shop in

Q89: A gross receipts tax is subject to

Q100: All 50 states impose a sales and

Q105: In recent years, states are weighting the

Q120: Roxy operates a dress shop in Arlington,

Q125: Gordon operates the Tennis Pro Shop in

Q126: Lefty provides demolition services in several southern