Multiple Choice

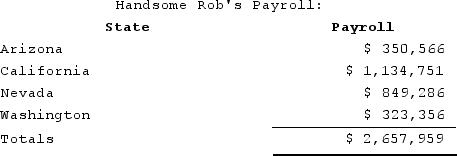

Handsome Rob provides transportation services in several western states. Rob has payroll as follows:  Rob is a California corporation and the following is true:

Rob is a California corporation and the following is true:

Rob hasincome tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $201,800 of payroll for services provided in Nevada by California-based drivers. What is Rob's California payroll numerator?

A) $932,951.

B) $1,134,751.

C) $1,215,401.

D) $2,657,959.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Use tax liability accrues in the state

Q16: Which of the following law types is

Q40: Which of the following is not a

Q41: Which of the following is not one

Q61: Assume Tennis Pro attends a sports equipment

Q65: Roxy operates a dress shop in Arlington,

Q77: Super Sadie, Incorporated, manufactures sandals and distributes

Q103: Nondomiciliary businesses are subject to tax everywhere

Q124: Tennis Pro is headquartered in Virginia. Assume

Q133: The throwback rule requires a company, for