Essay

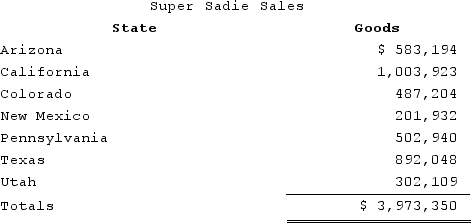

Super Sadie, Incorporated, manufactures sandals and distributes them across the southwestern United States. Assume that Super Sadie has sales tax nexus in Arizona, California, Colorado, New Mexico, and Texas. Super Sadie has sales as follows:

Assume the following sales tax rates: Arizona (6 percent), California (8 percent), Colorado (7 percent), New Mexico (6.5 percent), Pennsylvania (7.25 percent), Texas (8 percent), and Utah (5 percent). What is Super Sadie's total sales and use tax liability? (Round your interim calculations to the nearest whole number.)

Assume the following sales tax rates: Arizona (6 percent), California (8 percent), Colorado (7 percent), New Mexico (6.5 percent), Pennsylvania (7.25 percent), Texas (8 percent), and Utah (5 percent). What is Super Sadie's total sales and use tax liability? (Round your interim calculations to the nearest whole number.)

Correct Answer:

Verified

$233,900.

($583,194 × 6 percen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

($583,194 × 6 percen...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Big Company and Little Company are both

Q26: The Wayfair decision reversed the Quill decision,

Q27: What was the Supreme Court's holding in

Q48: Sales personnel investigating a potential customer's creditworthiness

Q66: Della Corporation is headquartered in Carlisle, Pennsylvania.

Q82: In which of the following state cases

Q96: Which of the following businesses is likely

Q97: Wacky Wendy produces gourmet cheese in Wisconsin.

Q100: Tennis Pro has the following sales, payroll,

Q139: Business income includes all income earned in