Short Answer

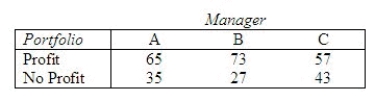

A study of the purchase decisions of three stock portfolio managers, A, B, C, was conducted to compare the numbers of stock purchases that resulted in profits over a time period less than or equal to 1 year. One hundred randomly selected purchases were examined for each of the managers.  Do the data provide evidence of differences among the rates of successful purchases for the three managers?

Do the data provide evidence of differences among the rates of successful purchases for the three managers?

Compute  = ______________

= ______________

The p-value is ______________.

Conclude that there ______________ enough information to conclude that the proportion of successful purchases will differ among the managers.

Correct Answer:

Verified

5.6264; be...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: All chi-square distributions are skewed to the

Q39: To determine whether a single coin is

Q40: An experiment was conducted to investigate the

Q41: A cafeteria proposes to serve 4 main

Q42: A contingency table classifies data with respect

Q44: Which of the following statements about a

Q45: A chi-square test for independence with 10

Q46: The personnel manager of a consumer products

Q47: The degrees of freedom associated with a

Q48: The degrees of freedom associated with a