Essay

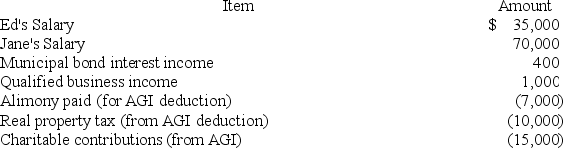

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's adjusted gross income?

Correct Answer:

Verified

$99,000 se...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: An individual receiving $5,000 of tax exempt

Q78: Earl and Lawanda Jackson have been married

Q79: Kabuo and Melinda got married on December

Q80: From AGI deductions are commonly referred to

Q81: Which of the following is not a

Q83: All of the following are tests for

Q84: Which of the following statements regarding dependents is

Q85: Anna is a 21-year-old full-time college student

Q86: For AGI deductions are commonly referred to

Q87: Which of the following statements regarding realized