Essay

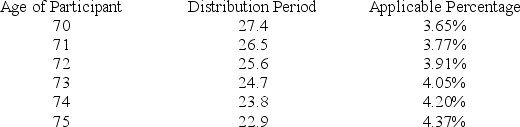

Sean (age 74 at end of 2018) retired five years ago. The balance in his 401(k) account on December 31, 2017 was $1,700,000 and the balance in his account on December 31, 2018 was $1,800,000. Using the IRS tables below, what is Sean's required minimum distribution for 2018?

Correct Answer:

Verified

For 2018, his required minimum distribut...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: This year, Ryan contributed 10 percent of

Q19: Which of the following statements concerning nonqualified

Q20: Riley participates in his employer's 401(k) plan.

Q21: Both employers and employees may contribute to

Q22: From a tax perspective, participating in a

Q24: Cassandra, age 33, has made deductible contributions

Q25: Jacob participates in his employer's defined benefit

Q26: Which of the following is not a

Q27: Which of the following describes a defined

Q28: Which of the following statements is True