Essay

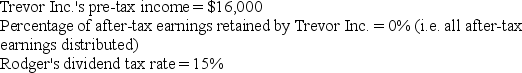

Rodger owns 100% of the shares in Trevor Inc., a C corporation. Assume the following for the current year:

Given these assumptions, how much cash does Rodger have from the dividend after all taxes have been paid?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Explanation: Owners of unincorporated entities can be

Q3: On which tax form do LLCs with

Q22: Unincorporated entities with only one individual owner

Q23: From a tax perspective, which entity choice

Q45: Which tax classifications can potentially apply to

Q47: If an individual forms a sole proprietorship,

Q48: If C corporations retain their after-tax earnings,

Q48: Beginning in 2018, C corporations are no

Q57: What kind of deduction is the deduction

Q73: On which tax form does a single-member