Essay

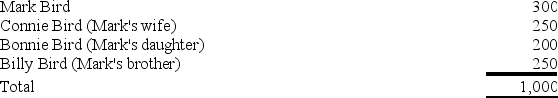

Tiger Corporation, a privately held company, has one class of voting common stock, of which 1,000 shares are issued and outstanding. The shares are owned as follows:

How many shares of stock is Mark deemed to own under the family attribution rules in a stock redemption?

Correct Answer:

Verified

750

Mark is deemed t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Mark is deemed t...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Pine Creek Company is owned equally by

Q22: Beltway Company is owned equally by George,

Q27: Grand River Corporation reported taxable income of

Q28: Greenwich Corporation reported a net operating loss

Q32: Madison Corporation reported taxable income of $400,000

Q32: This year the shareholders in Lucky Corporation

Q33: Ozark Corporation reported taxable income of $500,000

Q36: Which of the following statements is True?<br>A)

Q65: Wonder Corporation declared a common stock distribution

Q88: The "double taxation" of corporate income refers