Essay

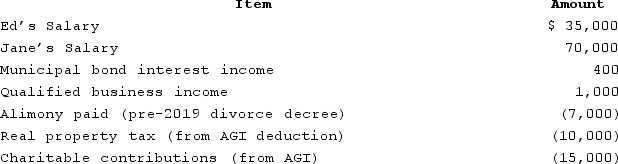

Jane and Ed Rochester are married with a 2-year-old child, who lives with them and whom they support financially. In 2020, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

What is the couple's gross income?

Correct Answer:

Verified

$106,000, ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Inventory is a capital asset.

Q20: The standard deduction amount varies by filing

Q32: Taxpayers who file as qualifying widows/widowers use

Q35: Itemized deductions and the standard deduction are

Q52: The relationship requirement is more broadly defined

Q64: Lebron received $50,000 of compensation from his

Q72: To be considered a qualifying child of

Q99: Jan is unmarried and has no children,

Q123: By the end of Year 1, Harold

Q129: All of the following are tests for