Essay

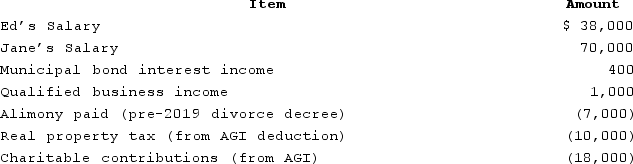

Jane and Ed Rochester are married with a 2-year-old child, who lives with them and whom they support financially. In 2020, Ed and Jane realized the following items of income and expense:

The Rochester's qualified for a $2,000 child tax credit and $2,900 in recovery rebate credit ($2,400 for themselves and $500 for their child). Assume the Rochesters did not receive the recovery rebate in advance. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

The Rochester's qualified for a $2,000 child tax credit and $2,900 in recovery rebate credit ($2,400 for themselves and $500 for their child). Assume the Rochesters did not receive the recovery rebate in advance. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800.

What is the couple's tax due or tax refund? (Use the tax rate schedules, not tax tables.)

Correct Answer:

Verified

$2,239 tax...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: A personal automobile is a capital asset.

Q30: Which of the following statements regarding exclusions

Q39: In addition to the individual income tax,

Q41: The relationship test for qualifying relative requires

Q49: In April of Year 1, Martin left

Q58: The relationship requirement for qualifying relative includes

Q79: It is generally more advantageous from a

Q92: The Inouyes filed jointly in 2020. Their

Q115: Jane and Ed Rochester are married with

Q118: Filing status determines all of the following