Essay

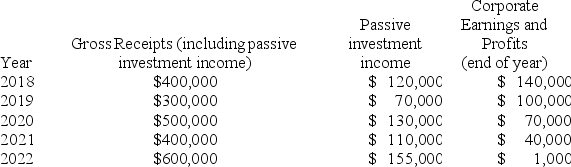

Neal Corporation was initially formed as a C corporation with a calendar year end. Neal elected S corporation status, effective January 1, 2018. On December 31, 2017, Neal Corp. reported earnings and profits of $150,000. Beginning in 2018, Neal Corp. reported the following information. Does Neal Corp.'s S election terminate due to excess net passive income? If so, what is the effective date of the termination?

Correct Answer:

Verified

The S election is terminated at the end ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: If an S corporation never operated as

Q43: To make an S election effective as

Q48: Assume that at the end of 2018,

Q49: Which of the following is prohibited from

Q50: Which of the following is not considered

Q56: SoTired, Inc., a C corporation with a

Q94: S corporations are not entitled to a

Q114: When an S corporation distributes appreciated property

Q116: Which of the following is a requirement

Q122: At the beginning of the year, Harold,