Essay

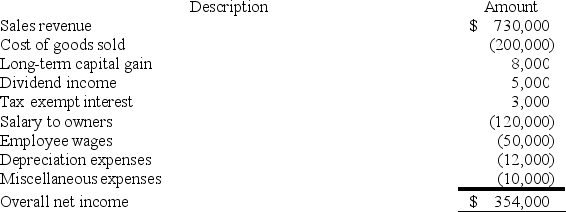

XYZ Corporation (an S corporation) is owned by Jane and Rebecca who are each 50% shareholders. At the beginning of the year, Jane's basis in her XYZ stock was $40,000. XYZ reported the following tax information for 2018.

Required:

a. What amount of ordinary business income is allocated to Jane?

b. What is the amount and character of separately stated items allocated to Jane?

c. What is Jane's basis in her XYZ corp. stock at the end of the year?

Correct Answer:

Verified

Parts a and b: See the followi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: C corporations that elect S corporation status

Q30: Which of the following statements is correct?<br>A)The

Q42: Separately stated items are tax items that

Q69: During 2018, CDE Corporation (an S corporation

Q70: Unlike partnerships, adjustments that decrease an S

Q72: Lamont is a 100% owner of JKL

Q77: Assume Joe Harry sells his 25% interest

Q91: The same exact requirements for forming and

Q107: Which of the following statements is correct

Q117: During the post-termination transition period, property distributions