Essay

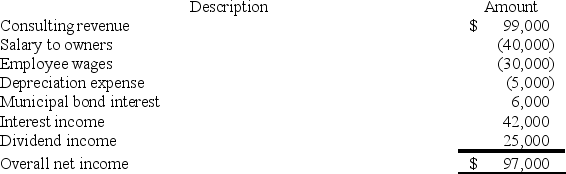

RGD Corporation was a C corporation from its inception in 2013 through 2017. However, it elected S corporation status effective January 1, 2018. RGD had $50,000 of earnings and profits at the end of 2017. RGD reported the following information for its 2018 tax year.

What amount of excess net passive income tax is RGD liable for in 2018? Assume the corporate tax rate is 21%. (Round your answer for excess net passive income to the nearest thousand).

Correct Answer:

Verified

$6,300 (21% × $30,000). Passive investme...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Jackson is the sole owner of JJJ

Q17: CB Corporation was formed as a calendar-year

Q19: Suppose at the beginning of 2018, Jamaal's

Q20: If Annie and Andy (each a 30%

Q23: Which of the following S corporations would

Q57: An S corporation can use a noncalendar

Q60: The IRS may consent to an early

Q77: Maria resides in San Antonio, Texas. She

Q118: In general, an S corporation shareholder makes

Q127: The built-in gains tax does not apply