Multiple Choice

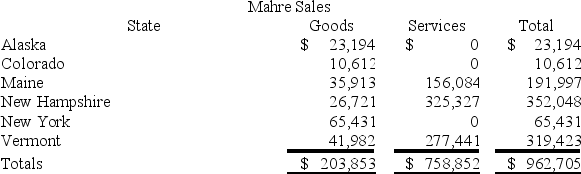

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store which ships to out-of-state customers. The ski tours operate in Maine, New Hampshire, and Vermont where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:

Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (6.75 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit in Maine?

A) $0

B) $3,053

C) $13,267

D) $16,319

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The trade show rule allows businesses to

Q7: Interest and dividends are allocated to the

Q21: Which of the following regarding the state

Q67: Public Law 86-272 protects only companies selling

Q95: Many states are either starting to or

Q106: Tennis Pro is headquartered in Virginia. Assume

Q109: On which of the following transactions should

Q114: Which of the following isn't a criteria

Q118: Giving samples and promotional materials without charge

Q137: Which of the following is not a