Multiple Choice

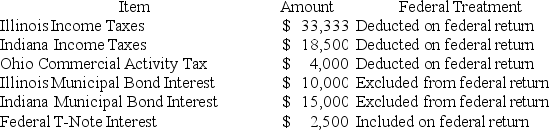

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

PWD's Federal Taxable Income was $100,000. Calculate PWD's Illinois state tax base.

A) $116,000

B) $130,833

C) $131,000

D) $164,333

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Public Law 86-272 protects solicitation from income

Q54: Roxy operates a dress shop in Arlington,

Q56: All of the following are False regarding

Q58: Tennis Pro is headquartered in Virginia. Assume

Q59: Tennis Pro has the following sales, payroll

Q61: Tennis Pro, a Virginia Corporation domiciled in

Q85: Bethesda Corporation is unprotected from income tax

Q108: Purchases of inventory for resale are typically

Q114: Use tax liability accrues in the state

Q115: Businesses subject to income tax in more