Essay

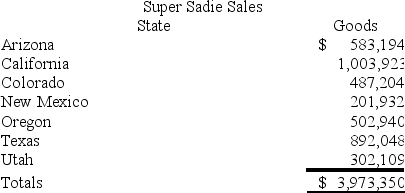

Super Sadie, Incorporated manufactures sandals and distributes them across the southwestern United States. Assume that Super Sadie has sales tax nexus in Arizona, California, Colorado, New Mexico, and Texas. Super Sadie has sales as follows:

Assume the following sales tax rates: Arizona (6 percent), California (8 percent), Colorado (7 percent), New Mexico (6.5 percent), Oregon (7.25 percent), Texas (8 percent), and Utah (5 percent). What is Super Sadie's total sales and use tax liability? (Round your interim calculations to the nearest whole number.)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: List the steps necessary to determine an

Q5: Mighty Manny, Incorporated manufactures ice scrapers and

Q6: Gordon operates the Tennis Pro Shop in

Q6: Business income is allocated to the state

Q9: Assume Tennis Pro attends a sports equipment

Q14: Most state tax laws adopt the federal

Q103: Nondomiciliary businesses are subject to tax everywhere

Q105: In recent years, states are weighting the

Q119: A state's apportionment formula usually is applied

Q132: Most states have shifted away from an