Essay

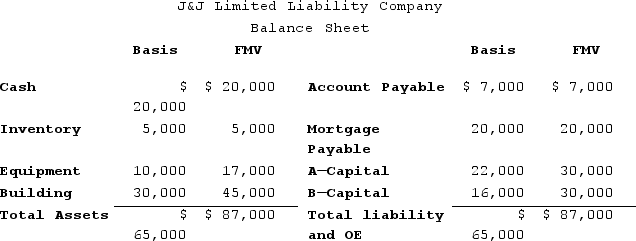

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Correct Answer:

Verified

If member C received a one-third capital...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Bob is a general partner in Fresh

Q10: A partnership with a C corporation partner

Q39: Ruby's tax basis in her partnership interest

Q43: Which of the following items is subject

Q66: Tim, a real estate investor, Ken, a

Q78: Under general circumstances, debt is allocated from

Q91: Which of the following does not adjust

Q96: What is the difference between a partner's

Q114: Partners must generally treat the value of

Q130: Which of the following statements regarding capital