Lincoln, Incorporated, Washington, Incorporated, and Adams, Incorporated, Form Presidential Suites

Essay

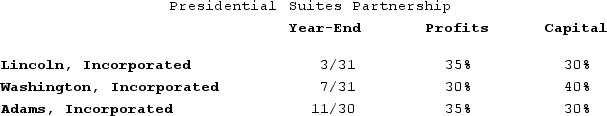

Lincoln, Incorporated, Washington, Incorporated, and Adams, Incorporated, form Presidential Suites Partnership on February 15, 20X9. Now, Presidential Suites must adopt its required tax year-end. The partners' year-ends, profits interests, and capital interests are reflected in the table below. Given this information, what tax year-end must Presidential Suites use, and what rule requires this year-end?

Correct Answer:

Verified

Because the partners all have different ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Does adjusting a partner's basis for tax-exempt

Q11: Which of the following statements regarding a

Q20: Frank and Bob are equal members in

Q62: Lloyd and Harry, equal partners, form the

Q65: Ruby's tax basis in her partnership interest

Q71: What is the rationale for the specific

Q73: Which of the following statements regarding the

Q88: Partnerships can use special allocations to shift

Q98: How does additional debt or relief of

Q102: John, a limited partner of Candy Apple,