Jordan, Incorporated, Bird, Incorporated, Ewing, Incorporated, and Barkley, Incorporated, Formed

Essay

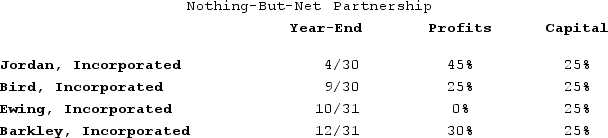

Jordan, Incorporated, Bird, Incorporated, Ewing, Incorporated, and Barkley, Incorporated, formed Nothing-But-Net Partnership on June 1st, 20X9. Now, Nothing-But-Net must adopt its required tax year-end. The partners' year-ends, profits interests, and capital interests are reflected in the table below. Given this information, what tax year-end must Nothing-But-Net use, and what rule requires this year-end?

Correct Answer:

Verified

Because the partners all have different ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Which of the following statements exemplifies the

Q35: Erica and Brett decide to form their

Q41: Styling Shoes, LLC, filed its 20X8 Form

Q49: On April 18, 20X8, Robert sold his

Q68: If a taxpayer sells a passive activity

Q87: What general accounting methods may be used

Q90: A partnership may use the cash method

Q102: KBL, Incorporated, AGW, Incorporated, Blaster, Incorporated, Shiny

Q104: Hilary had an outside basis in LTL

Q117: In what order should the tests to