Essay

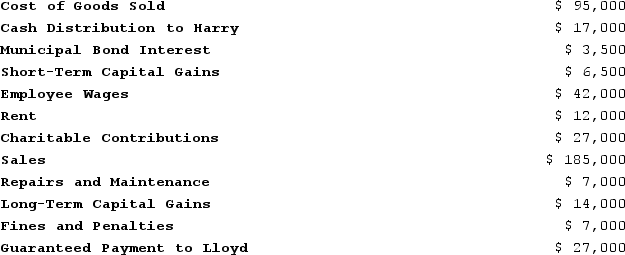

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss) and what separately stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss) and what separately stated items should be allocated to each partner for the year?

Correct Answer:

Verified

The amount of ordinary busines...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Adjustments to a partner's outside basis are

Q11: Ruby's tax basis in her partnership interest

Q19: The term "outside basis" refers to the

Q54: In X1, Adam and Jason formed ABC,

Q67: A partner can generally apply passive activity

Q83: Jerry, a partner with 30percent capital and

Q93: Tom is talking to his friend Bob,

Q99: What type of debt is not included

Q116: Why are guaranteed payments deducted in calculating

Q117: On 12/31/X4, Zoom,LLC, reported a $58,500 loss