Essay

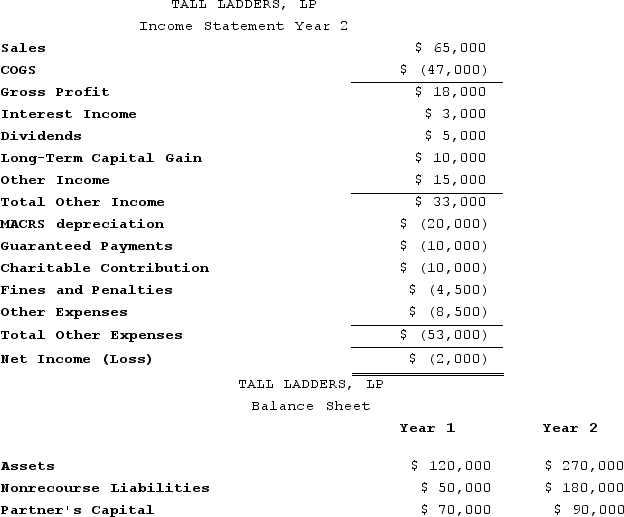

At the end of Year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For Year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following income statement and balance sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of Year 2?

Correct Answer:

Verified

Tony's adjusted basis at the end of Year...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Does adjusting a partner's basis for tax-exempt

Q28: Guaranteed payments are included in the calculation

Q37: Partnerships can request up to a six-month

Q42: How does a partnership make a tax

Q53: A general partner's share of ordinary business

Q64: Zinc, LP was formed on August 1,

Q65: This year, HPLC, LLC, was formed by

Q77: A partner's outside basis must first be

Q104: Fred has a 45percent profits interest and

Q112: Tax elections are rarely made at the