Essay

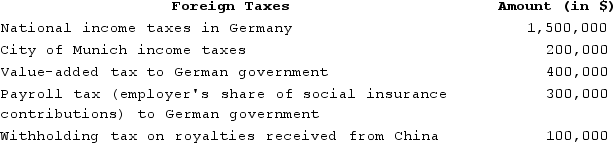

Rainier Corporation, a U.S. corporation, manufactures and sells quidgets in the United States and Europe. Rainier conducts its operations in Europe through a German GmbH, which the company elects to treat as a branch for U.S. tax purposes. Rainier also licenses the rights to manufacture quidgets to an unrelated company in China. During the current year, Rainier paid the following foreign taxes, translated into U.S. dollars at the appropriate exchange rate:

What amount of creditable foreign taxes does Rainier incur?

What amount of creditable foreign taxes does Rainier incur?

Correct Answer:

Verified

$1,800,000. The creditable inc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Deductible interest expense incurred by a U.S.

Q15: Which of the following persons should not

Q24: Alhambra Corporation, a U.S. corporation, receives a

Q25: Which of the following transactions engaged in

Q41: Portsmouth Corporation, a British corporation, is a

Q51: Which of the following items of foreign

Q60: Manchester Corporation, a U.S. corporation, incurred $210,000

Q63: Which tax rule applies to an excess

Q68: Provo Corporation, a U.S. corporation, received a

Q86: Pierre Corporation has a precredit U.S. tax