Multiple Choice

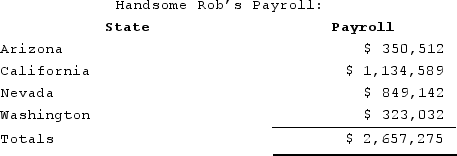

Handsome Rob provides transportation services in several western states. Rob has payroll as follows:  Rob is a California corporation and the following is true:

Rob is a California corporation and the following is true:

Rob has income tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $200,000 of payroll for services provided in Nevada by California-based drivers. What is Rob's California payroll numerator?

A) $934,589

B) $1,134,589

C) $1,215,347

D) $2,657,275

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Interest and dividends are allocated to the

Q24: Big Company and Little Company are both

Q31: Mighty Manny, Incorporated manufactures ice scrapers and

Q33: Assume Tennis Pro discovered that one salesperson

Q70: All of the following are false regarding

Q108: Purchases of inventory for resale are typically

Q114: Which of the following isn't a requirement

Q122: Roxy operates a dress shop in Arlington,

Q133: The throwback rule requires a company, for

Q134: All states employ some combination of sales