Multiple Choice

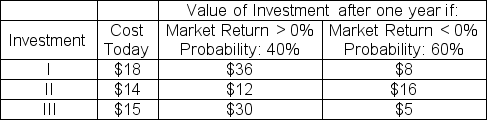

Given the following information, which investment(s) would risk-averse investors prefer if the risk-free rate is 5%?

A) I only

B) II only

C) III only

D) I and II only

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q99: Which of the following investments would a

Q100: Which of the following is a TRUE

Q101: What is the beta of a portfolio

Q102: Suppose the returns on Security A are

Q103: The risk-free rate is 5.25%.The expected return

Q105: Stock A has a standard deviation of

Q106: Suppose the beta of a four-asset portfolio

Q107: What is the standard deviation of

Q108: Which of the following is a FALSE

Q109: What is the standard deviation of an