Multiple Choice

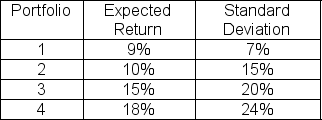

The expected return on the market is 11.5% with a standard deviation of 13% and the risk-free rate is 4%.Which of the following portfolios are undervalued?

A) 1 and 2 only

B) 1 and 4 only

C) 2 and 3 only

D) 3 and 4 only

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: The expected return of Security A is

Q5: What is the main criticism of the

Q6: Stock XYZ has a beta of 1.6

Q7: Which one of the following is NOT

Q8: The expected return of Security A is

Q10: Which one of the following is NOT

Q11: SML-CAPM Question:<br>Antigone Inc.recently paid out a dividend

Q12: The Capital Asset Pricing Model (CAPM)relates:<br>A)expected return

Q13: Which of the following is NOT a

Q14: What is the expected payoff from an