Multiple Choice

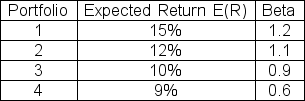

The expected return on the market is 12% with a standard deviation of 16% and the risk-free rate is 4.5%.Which of the following portfolios are overpriced?

A) 1 and 3 only

B) 1 and 4 only

C) 2 and 3 only

D) 2 and 4 only

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q68: The Capital Market Line (CML)relates:<br>A)expected return to

Q69: Use the following three statements to answer

Q70: What is the standard deviation for a

Q71: Given the following information, what is the

Q72: Stock Z is currently selling for $16.72.It

Q74: Suppose you have $5,000 to invest in

Q75: A portfolio consists of two securities: a

Q76: The _ measures the sensitivity of the

Q77: Which of the following is a FALSE

Q78: The risk-free rate is 4.5%.The expected return