Multiple Choice

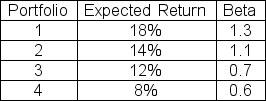

The expected return on the market is 14% with a standard deviation of 18% and the risk-free rate is 5%.Which of the following portfolios are underpriced?

A) 1 and 2 only

B) 1 and 3 only

C) 2 and 3 only

D) 3 and 4 only

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q34: The CAPM Model makes the following assumptions

Q35: The market expected return is 14% with

Q36: "There may be some truth in the

Q37: Use the following two statements to answer

Q38: What is the expected return for a

Q40: Stock A has a standard deviation of

Q41: Beta is a measure of:<br>A)Total risk.<br>B)Diversifiable risk.<br>C)Systematic

Q42: Stock Z has a standard deviation of

Q43: Suppose you have $4,000 to invest in

Q44: According to the Capital Asset Pricing Model