Multiple Choice

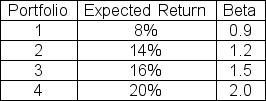

The expected return on the market is 12% with a standard deviation of 20% and the risk-free rate is 4%.Which of the following portfolios are correctly priced?

A) 1 and 2 only

B) 1 and 4 only

C) 2 and 3 only

D) 3 and 4 only

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q51: A portfolio has $1,200 invested in a

Q52: Suppose you have $2,000 to invest.The market

Q53: Use the following three statements to answer

Q54: The expected return on the market is

Q55: What is the beta of a portfolio

Q57: When using the CAPM to estimate long-term

Q58: Stock X has a standard deviation of

Q59: Stock Y has a beta of 0.8

Q60: The expected return on the market is

Q61: Stock Y has a standard deviation of