Multiple Choice

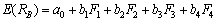

Suppose the returns on Security B are linearly related to four risk factors: F1, F2, F3, and F4.The required rate of return on Security B can be determined as follows:  .The risk-free rate is 5%.What is the risk premium for F4, if the required return of Security B is 20%, b1, b2, b3, and b4 are 0.5, 0.7, 0.6, and 0.9, respectively, and F1, F2, and F3 are 4.25%, 5.75%, and 6.5%, respectively?

.The risk-free rate is 5%.What is the risk premium for F4, if the required return of Security B is 20%, b1, b2, b3, and b4 are 0.5, 0.7, 0.6, and 0.9, respectively, and F1, F2, and F3 are 4.25%, 5.75%, and 6.5%, respectively?

A) 4.95%

B) 5.50%

C) 7.42%

D) 11.06%

Correct Answer:

Verified

Correct Answer:

Verified

Q24: What is the main difference between CAPM

Q25: The expected return of the market portfolio

Q26: _ is a measure of the risk

Q27: Which of the following is NOT a

Q28: The beta of a portfolio can be

Q30: Greg has $10,000 to invest in a

Q31: Use the following three statements to answer

Q32: The expected return on the market is

Q33: What does the capital market line represent?<br>A)The

Q34: The CAPM Model makes the following assumptions