Essay

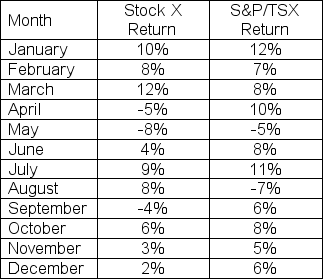

Given the following information:

a)What are the average monthly returns on Stock X and the S&P TSX?

b)What are the standard deviations of the monthly returns on Stock X and the S&P TSX?

c)What is the covariance of the returns on Stock X and the S&P TSX?

d)What is the beta of Stock X?

e)What is the implied risk-free rate?

Correct Answer:

Verified

a)Stock X average monthly return  S&P/TS...

S&P/TS...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Theoretically, what is meant by the market

Q83: The market portfolio is most accurately described

Q84: What is the difference between the security

Q85: How do you explain a stock that

Q86: Use the following statements to answer this

Q88: Security A is estimated to be linearly

Q89: Briefly describe what beta ( <span

Q90: Assuming the CAPM is valid, _ securities

Q91: Which of the following is a FALSE

Q92: By combining the risk-free asset and the