Multiple Choice

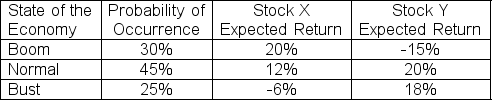

Given the following forecasts, what is the correlation between securities X and Y?

A) -0.0098

B) 0.0098

C) -41.38

D) -0.6371

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q57: No benefits of diversification can occur with

Q58: You have done a thorough study

Q59: What is the correlation between stocks Y

Q60: Amazon's new mobile phone 'Fire' spectacularly under-performed

Q61: For the following efficient frontier, the standard

Q63: The geometric average quarterly return of ROM

Q64: Use the following two statements to answer

Q65: The standard deviation and expected returns for

Q66: AMC Corp had a geometric weekly return

Q67: Suppose you plan to create a portfolio