Multiple Choice

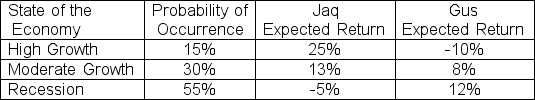

Cinderella plans to form a portfolio with two securities: Jaq and Gus.The correlation between the two securities is -1.Given the following forecasts, what are the weights in Jaq and Gus that will set the standard deviation of the portfolio equal to zero?

A) Portfolio weights in Jaq and Gus are 74.37% and 25.63%, respectively

B) Portfolio weights in Jaq and Gus are 25.63% and 74.37%, respectively

C) Portfolio weights in Jaq and Gus are 60.51% and 39.49%, respectively

D) Portfolio weights in Jaq and Gus are 39.49% and 60.51% respectively

Correct Answer:

Verified

Correct Answer:

Verified

Q71: You have been given the following forecasts

Q72: Suppose you plan to create a portfolio

Q73: What is the expected return for a

Q74: Suppose you are given the following forecasts

Q75: The expected returns for Bumpy Inc.and Bouncy

Q77: Richards & Co.Analysts has recently published a

Q78: Which of the following is not a

Q79: Given the following forecasts, what is the

Q80: Given the following forecasts, what is the

Q81: You have observed the following for Montreal