Multiple Choice

Felix has been offered a three-year ordinary annuity with annual payments of $1,500.The current price to purchase this annuity is $2,700.Which of the following is the most appropriate timeline for this investment?

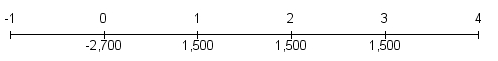

A)

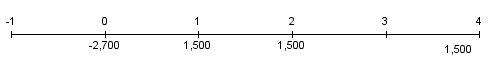

B)

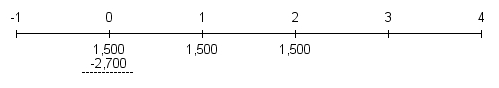

C)

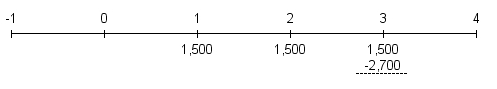

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q20: Provide an appropriate response.<br>-Explain the difference between

Q53: Montreal Financial Services Company offers a perpetuity

Q54: In 30 years, you plan to set

Q55: As the amortization period of a mortgage

Q56: You have just obtained a $150,000 10-year

Q57: Xiang invests $25,000 per year, starting today,

Q59: Franklin needs to have $1,000 in 8

Q60: To compare interest rates, we should compare

Q61: If I invest $1,000 in a financial

Q62: Your credit card has a quoted rate