Multiple Choice

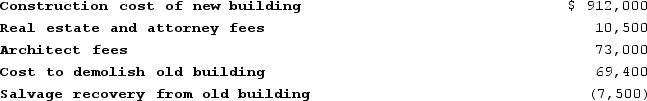

On January 6, Year 1, Mount Jackson Corporation purchased a tract of land for a factory site for $770,000. An existing building on the site was demolished and the new factory was completed on October 11, Year 1. Additional cost data are shown below:  Which of the following are the capitalized costs of the land and the new building, respectively?

Which of the following are the capitalized costs of the land and the new building, respectively?

A) $842,400 and $985,000

B) $780,500 and $1,046,900

C) $849,900 and $977,500

D) $770,000 and $1,057,400

Correct Answer:

Verified

Correct Answer:

Verified

Q27: The acronym MACRS stands for<br>A)Modified Accelerated Cost

Q29: On January 1, Year 1, Vanguard Company

Q31: On January 1,Year 1,Zach Company purchased equipment

Q35: Farmer Company purchased machine on January 1,

Q36: On January 1, Year 1, Friedman Company

Q37: On January 1, Year 1, Marino Moving

Q71: In choosing a depreciation method for financial

Q82: The depreciable cost of a long-term asset

Q86: Describe what is meant by the term

Q98: Intangible assets include patents,copyrights,and franchises.