Multiple Choice

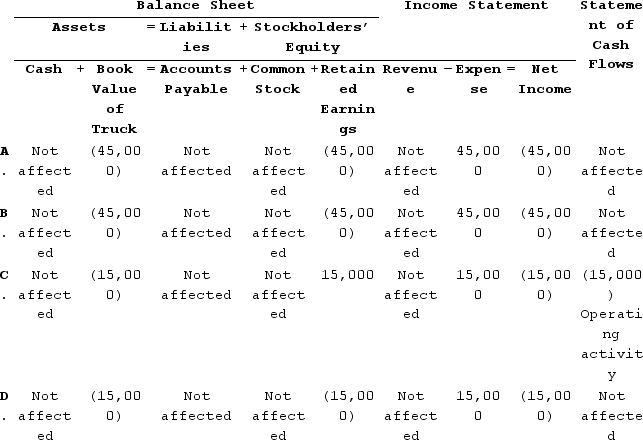

On January 1, Year 1, Marino Moving Company paid $64,000 cash to purchase a truck. The truck was expected to have a four year useful life and a $4,000 salvage value. If Marino uses the straight-line method, which of the following shows how the adjusting entry to recognize depreciation expense at the end of Year 3 will affect the Company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Which of the following statements is true

Q63: On January 1, Year 1, Phoenix Corporation

Q64: Renewable Energies, Incorporated (REI)paid $100,000 to purchase

Q65: When reporting to the Internal Revenue Service

Q67: Renewable Energies, Incorporated (REI)paid $100,000 to purchase

Q71: The balance sheet of Flo's Restaurant showed

Q72: The balance sheet of Flo's Restaurant showed

Q73: Expenditures that extend the useful life of

Q83: Which of the following terms is used

Q85: Which of the following would most likely