Essay

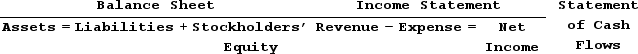

Indicate how each event affects the financial statements. Use the following letters to record your answer in the box shown below. If an event increases one account and decreases another account equally within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter dollar amounts.Increase = I Decrease = D Not Affected = NAOn January 1, Year 1, the Baker Company purchased an asset for $200,000. The asset had a $50,000 salvage value and a 10-year life. Baker uses the straight-line method. At the beginning of Year 3, the asset was sold for $174,000. Show how the sale will affect Baker's financial statements, assuming that Baker uses straight-line depreciation.

Correct Answer:

Verified

Annual depreciation expense = (Cost of ...

Annual depreciation expense = (Cost of ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: Explain the meaning of the terms "tangible"

Q135: Farmer Company purchased machine on January 1,

Q136: Mays Corporation purchased a new truck on

Q138: Flagler Company purchased equipment that cost $90,000.

Q140: Indicate how each event affects the financial

Q141: Pierce Corporation, a U.S. business, is a

Q142: Depletion of a natural resource is usually

Q143: Anchor Company purchased a manufacturing machine with

Q144: On January 1, Year 1, Jing Company

Q160: Accumulated Depreciation is reported on the income